In long run, it is better that exchange your euros to another currency or invest that money.

The Euro is going to collapse.

As Miyamoto Musashi puts it: “When the going gets rough in a battlefield, overwhelming you with too many small details, when you are not able to tell who is progressing, your opponent or you – that is when you need to disregard those small details, and look at the bigger picture”.

I take the view that the current economic situation is overwhelming with small details that need to be disregarded so as to focus on the essence.

So, what seems to be the structure of the Greek debt? Well, they owe a total of about 350 billion Euros, of which, 50 billion went to the private sector, and 100 billion went to the public sector and the consolidation in the public sector at the beginning of the crisis. After that, the whole remaining amount of money came as a 200-billion-Euro “assistance” to the Greeks to pay the interest rates on the initial loan. So, the original debt is 150 billion Euros, whereas the amount of another 200 billion simply represents “loan sharking” and throwing Greece into mud and into the spiral of debts which are impossible to pay.

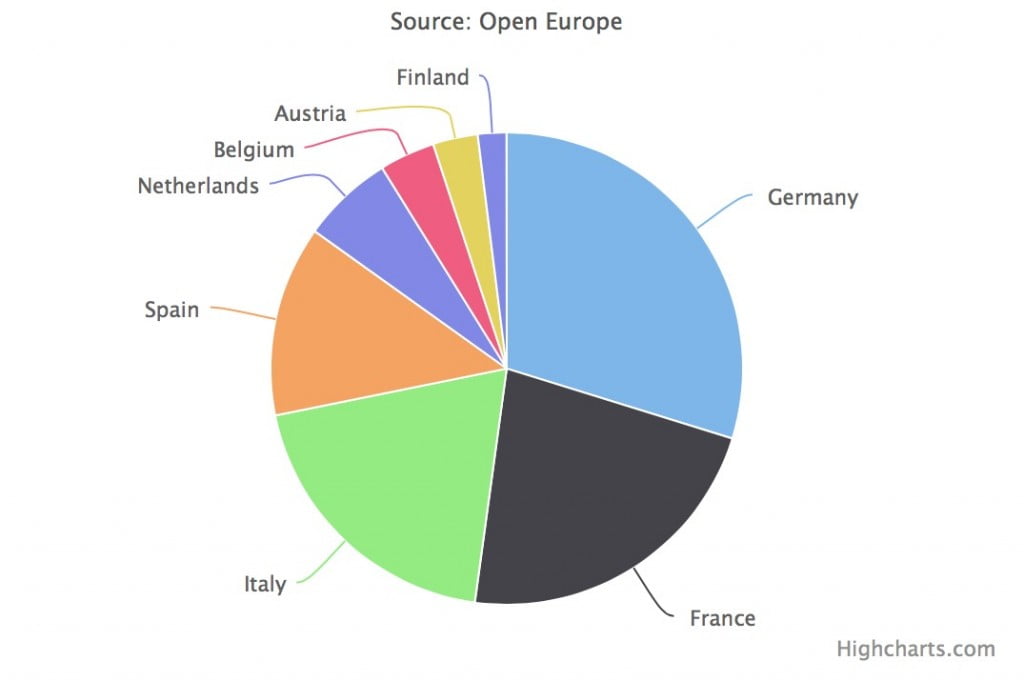

Why did banks allow so much debt occurrence to take place? Simply speaking, the lot of banking vultures from Frankfurt, Brussels, London and Paris teamed up around the idea to make big profits on loan interests. What they did was a nonsense, and now, there is no solution except that the creditors suffer the losses, and withstand the consequences of the delinquent loans. However, the banks refuse to do it, and that is where this political crisis stems from.

At the moment, most Greeks believe that Germany, having tried and not managed to conquer Europe twice through two world wars, is now utilizing economy instead of weapons for that purpose. I will not enter the debate of whether it is true or not, but I am talking about a specific sentiment, the sentiment which many of us in Europe feel to be true. Nevertheless, there is a fundamental problem, and the problem is that Germany and the rest of Europe do not have a debt collecting mechanism.

How will Europe collect the debt?

Even if all the overseas Greek state-owned assets were seized, they still could not cover as little as few percents of the debt. Another option is confiscation, but, of what property, and, of whose property? The private sector has received 50 billion Euros, and, assumed, a large part was spent on the construction of suites and hotels, but a portion was also spent on salaries, advertising and similar non-tangible items. Of the 100 billion assigned to the public sector, a certain portion was invested in infrastructure at best, but I am afraid that more was spent on financial consolidation. The question is what can be confiscated of the items which those 150 billion were spent on. For example, hotels can be taken away, but, what if the money went on debt or salary payment?

How is that property supposed to be confiscated? It is obvious that the Greeks themselves are not going to let it happen willingly. By force? German military is miniature and Germany does not border Greece, Europe itself does not have its own armed forces and finally Greece is a member of the NATO Alliance and has a quite substantial army. So situation is very complicated. The banks should not have allowed such enormous debt to happen in the first place. The banks are the ones who should suffer this loss, but in that case the Euro would devalue drastically. In that case it would come out cheaper for Germany to react quickly, bust the monetary union and return to the Deutsch Mark by the principle of 1 Euro = 2 Deutsch Marks as they did when they introduced the Euro.

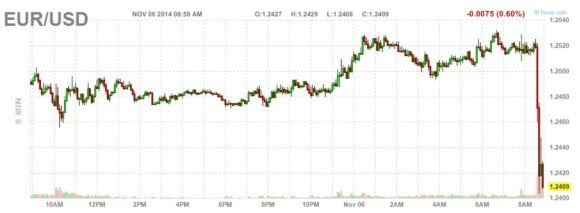

What if Greece started gradually leaving the EU? It seems to me that the EU would have to beg the Greeks just to pretend that they are going to pay the debt, even though they do not intend to do so. If the Greeks were leaving the EU, saying they would not or could not pay the debt value of the Euro would tremendously fall. I think that Mario Draghi’s move to put 1500 billion Euros into circulation has more to do with the preparation for the Greek crisis than with economic enhancement. In other words, the Euro was deliberately devalued below the real value, so that now they will be able to return that value when it finds it suitable and panic in the market would thus be avoided.

One thing is certain – there is no way Greece can pay the debt. Another certainty is that the Greek people do not want to pay that debt even if that means leaving the EU and that is what they expressed at the referendum after all. The third certainty is that Europe does not want to give up the interest rates even if that means the abandoning of the EU by Greece. The fourth certainty is that America needs Greece as that country is one of the key members of the NATO relevant for the position of the US troops in the Mediterranean, important for the balance in Turkey… And, the fifth certainty is that nothing is certain. ![]()

Two highly probable scenarios:

- Greece leaves the EU, and says it is not going to pay the debt – the Euro collapses. To me this scenario seems less probable for I believe that the Western allies will do everything in their power to prevent Greece from crossing over to the BRICS camp.

- Greece formally remains an EU member state, saying it is going to pay the debt, but in reality it cannot – the Euro collapses again but in the long run. The Americans push the allies that Greece remains part of the EU and does not jeopardize the NATO Alliance. They write off a part of the Greek debts and on the face of it the rest of the debts will be paid by the Greeks, but in fact that portion will also be written off later on. Further, the efforts by the whole West to replace the current authorities in Greece are absolutely clear. In that case it is not the banks who will bear the heaviest burden of granting the questionable loans but once the general public is deluded the real burden will fall to tax payers throughout Europe.

Several highly improbable scenarios:

I recommend that you read the book “The Black Swan” which is very popular with economists, players in stock exchange markets and startup investors. Book is written by Nassim Taleb, a philosopher, mathematician and stock exchange expert. In the book he discusses the impact of some very improbable events on mathematical models, science, stock exchange, economics or history. Those events can be predicted by nobody but when they happen they turn everything upside down and after that the old rules do not apply. He labeled such events as “black swans”. Here are a few ideas of “black swans” though I stress that there are yet many more “swans” impossible to foresee:

- The West helps the execution of a coup in Greece and the setting up of a puppet government, as was the military junta of 1967, in order to remove the threats to the NATO and the EU. Then they would manage to put Greece in chains and they will continue with the payment of the debt or at least with the declaration of the willingness to pay. In that case with the present public opinion a silent civil war would be going on. Remember that Greece has a history of left-wing revolutionary organizations, such as “November 17th”.

- Germany might assess that the return to the Deutsch Mark is more worthwhile. Angela Merkel has repeatedly noted that if they do not manage to defend the Euro it will be the end of the monetary union.

- The European Monetary Union might crush and the PIGS countries (Portugal, Italy and Spain) might be gradually abandoning the EU. Such moves might strengthen the Euro in the long-term but the question is whether the monetary union would survive until then.

- China, Russia and the BRICS member countries might influence the entire model. Maybe Greece sluggishly crosses over to another block and Russia succeeds in putting the idea of Euro-Asia into practice.

- Europe might decide to write off ⅔ of the Greek debt. In that case the Euro loses its value but returns stronger a few years on.

Final conclusion

Economics is not a science. Economics falls into the same category as meteorology. Economists are capable of forecasting basic trends only in regular situations but even then they are not able to predict what the currency exchange rate or a stock price will be the following day. Furthermore, in the case of a crisis or unusual events such as this situation with Greece all models and forecasts easily come to nothing. In such situations an ordinary cab driver knows just as much as an economist. That is why I take the liberty to write this article. ![]()

https://www.youtube.com/watch?t=1&v=4NiauhOCfsk

Money is a mere piece of paper with a promise drawn on it. You get the promise that what is inscribed on it represents the worth of the certain amount of something. Depending on the currency, that promise is given by America (USD), by Europe (EUR), by China, Canada… If Europe succeeds in persuading general public and investors that they can collect the debt, and that the European promise still stands, the Euro will remain strong. Nevertheless, I think that the situation is too complicated, that the EU is not mature enough for serious moves, and that there is the danger of black swans. This model is too complex, and therefore, more likely to crush.

Again, if you have a larger amount of Euros – take my advice, and invest the money, or change the currency.